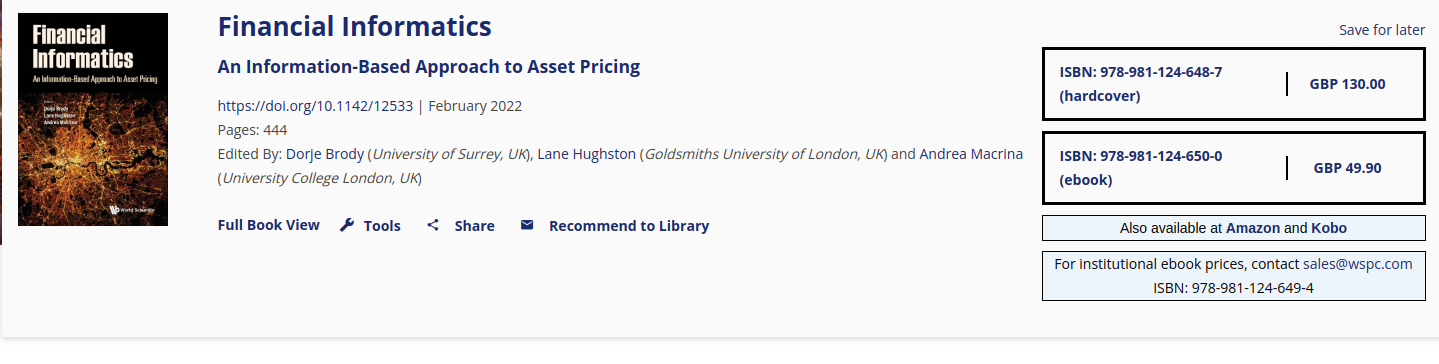

The book “Financial Informatics” was published this year by World Scientific (link here). It was edited by Dorje Brody, Lane Hughston (Goldsmiths University of London) and Andrea Macrina (University College London). The book presents the Brody-Hughston-Macrina approach to information-based asset pricing. The BHM approach introduces a new way of looking at the mechanisms determining price movements in financial markets in which each asset is defined by a collection of cash flows and each such cash flow is associated with a family of one or more so-called information processes that provide partial information about the cash flow. The 444-page book brings together a collection of 18 foundational papers of the subject by Brody, Hughston, and Macrina, many written in collaboration with various co-authors. There is a preface summarizing the current status of the theory, together with a brief history and bibliography of the subject. The screenshot below shows the publishers masthead for the book.