Starting university is such an exciting prospect, it’s a chance to move away from home and gain your own independence. However, with this independence comes responsibility too, the responsibility of managing your money. Budgeting can definitely seem a bit boring and something you might not want to think about before going to university, but it is so important! Therefore, in this blog I will talk about some money saving tips, including how to create a student budget.

Money saving tips:

Create your student budget

Once your student loan drops it is easy to feel quite well-off, but remember, this needs to last you a whole semester. Creating a budget is the key to keeping an eye on your money, you will then know exactly how much money is coming in and going out.

First of all, you want to establish how much money you are going to have for the semester. The best way to do this is to calculate how much money you will have incoming e.g. student loan, parental support, part-time job earnings etc. Then, you should do a rough estimate of your essential outgoings per semester, this will be money you spend on things like food, rent, essential course materials and transport. This will then give you an idea of how much you’ll have left to play with for that semester for non-essential things such as eating out. Save The Student provide an excellent budgeting spreadsheet that is definitely worth using, you can download it via this link.

Budgeting apps

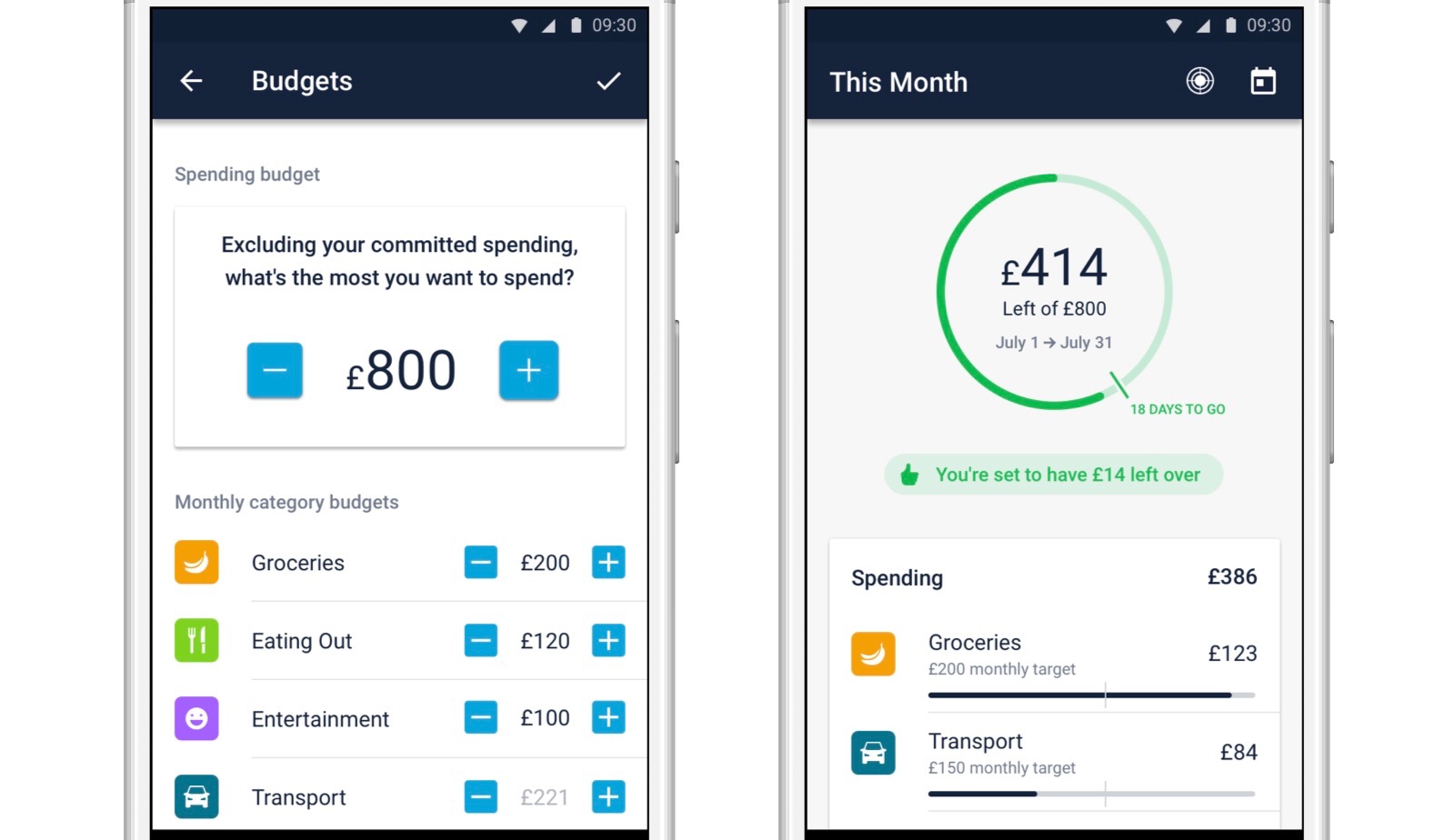

A great way to keep an eye on your budget and how much you are spending is to use apps like Monzo or Sterling. They make it easy to see how much you are spending and also what on, they group purchases into categories and so you can regularly check if you are spending too much on certain things like groceries or eating out.

This is an example of the app ‘Monzo’ and the budgeting tools available.

Student discount

One advantage of being a student is being able to get discount from lots of high street shops and some restaurants too! It is worth downloading the Unidays app, on the app you’ll be able to see all available discounts.

You can also apply for a 16-25 railcard, this can save you a third on rail travel. It is estimated that over a year, you could save an average of £189! If you apply to have a student back account with Santander they actually give you a free railcard when you open up your account.

Know your spending pitfalls

At home you might be used to eating food from Waitrose but as a student an easy way to save some money is to switch to cheaper alternatives, like using supermarkets’ own brands. Meal planning is also a good idea, it helps reduce food waste and helps you save money too. Plan for the week ahead and write down all necessary ingredients and this will help make sure you are only buying things you actually need.

Another habit that can quickly add up is buying takeaways coffees or buying your lunch, it might seem like a harmless few pounds here and there but in the long run it can amount to a lot of money. Instead, why not make a coffee at home and bring it in a reusable coffee cup or make a lunch you can bring in to university with you? It’s an easy way to save money.

Finding part-time work

Getting a part-time job can be a good idea if you want to have a bit of extra money to play with. Most universities suggest working no more than around 12 hours a week, to ensure you still have enough time for studying. I have worked throughout my whole time at university and I really enjoyed getting a bit of extra money each month and I found it also helped give me a bit more structure and routine. If you are wanting to get a job at university, I would suggest looking the summer before you arrive as this will help you to avoid peak job-hunting season.