This may or may not seem a silly question to you. The reason I ask is that there is a mechanism in place to determine bang for the taxpayer pound in research. In its current incarnation it is called REF (Research Excellence Framework). It’s purpose is to “provide accountability for public investment in research.” As Higgs himself notes in a recent interview in The Guardian, judged by the criteria of the REF he would be found wanting.

This may or may not seem a silly question to you. The reason I ask is that there is a mechanism in place to determine bang for the taxpayer pound in research. In its current incarnation it is called REF (Research Excellence Framework). It’s purpose is to “provide accountability for public investment in research.” As Higgs himself notes in a recent interview in The Guardian, judged by the criteria of the REF he would be found wanting.

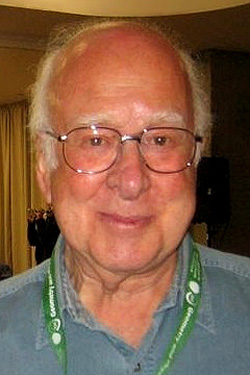

Indeed, as he notes in the article, he was found wanting by REF’s predecessor (he is now 84, retired and so no longer assessed). That Higgs would not pass muster in the REF has been noted before. The REF essentially requires 4 papers over a typically 6 year period, that are then peer-reviewed to determine a mark for the scientist. Higgs published few papers, too few to have the 4 required. This is unusual, most academics publish at least 1 paper a year. He is also unusual in having won a share of a Nobel prize for “for the theoretical discovery of a mechanism that contributes to our understanding of the origin of mass of subatomic particles” (to quote the Physics Nobel prize motivation). To say that Higgs went for quality over a quantity is somewhat of an understatement.

So if value for taxpayer money is measured by productivity, then Peter Higgs was poor value for money. But judged by his impact on how we see the world, then the salary he drew at the taxpayer funded University of Edinburgh was pretty outstanding value. It is up to you whether you think he delivered value for money*.

But it is up to our government to determine what they think is value for your money. The current system, although it has advantages, clearly discourages university academics from being very ambitious and spending 10 years on an important but hard problem. Mass is not the only problem like this, some of what is now textbook knowledge of cancer also took a long time to be understood and appreciated.

*As it happens I think he retired about the time I got this job and started paying taxes, but I would have been happy to contribute to his salary.

*As it happens I think he retired about the time I got this job and started paying taxes, but I would have been happy to contribute to his salary.

– You started paying taxes as soon as you spent pocket money on sweets!

Good point, thanks very much for that. It is lovely to think that my buying sweets and Lego as a lad contributed some (admittedly small) amount to a future Nobel Laureate’s salary.