How are you guys? It is currently Easter break! I guess you guys are staying home with your family, due to the restricted movement control implemented by the Malaysian government. However, this is somehow a great opportunity for us to accompany our parents and siblings. I wish you guys are safe and fine, and continue to be so 😊.

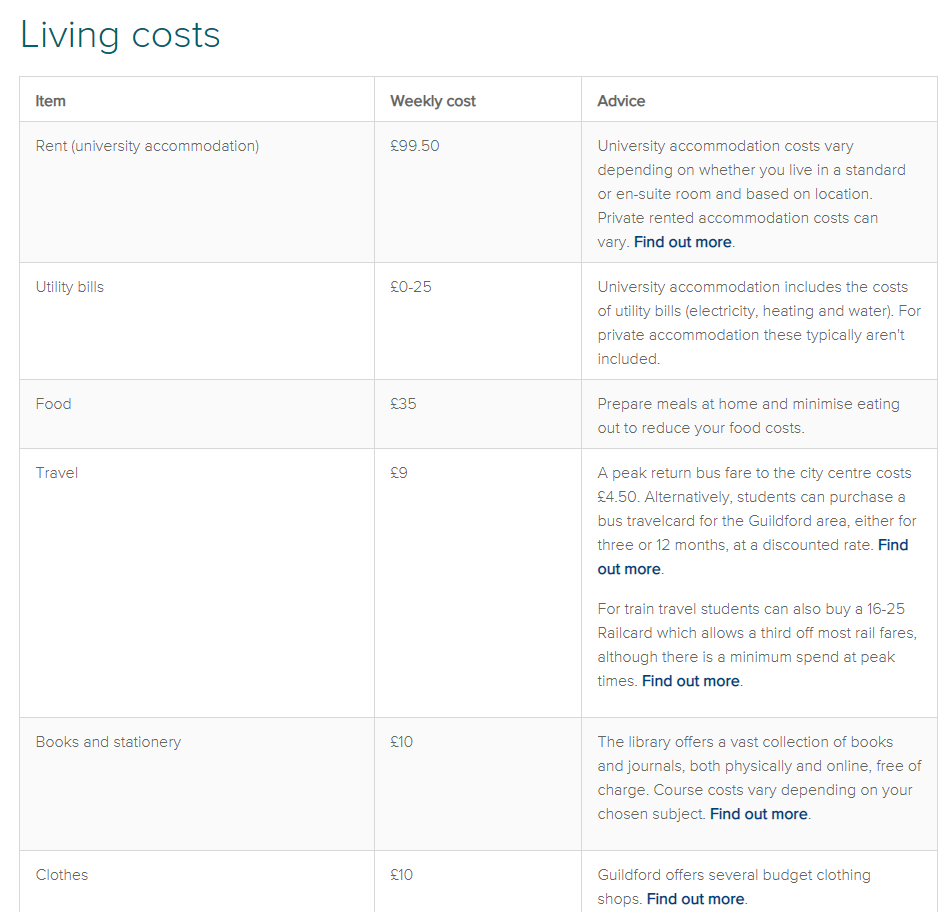

This week, I would like to share some tips about how I manage my money as a student. As you might know, it is quite expensive to live in the UK, considering the currency (£1= RM5.42), and relatively high living quality here. Particularly, Guildford is only a 40 minutes train away from the capital city, London. Therefore, it is even more expensive to live in Guildford. As a student, we have to pay for the rent for accommodation, tuition fee, living expenses, and sometimes transportation fee. Hence, our finance management could be crucial in our uni life.

Actually, there is a free online resource recommended by our uni, called Blackbullion. It provides education about budgeting, debt, saving, investing, start-up businesses and how to maximise your money for the future. You can also have access to a list of bursaries and scholarships available to apply in Blackbullion (but most of them are not open for international students, so sad…). Moreover, our university website provides information required for budgeting as well. Here is the link: https://www.surrey.ac.uk/fees-and-funding/managing-your-money/budgeting . There are also tons of budgeting apps and calculators available online.

Basically, a budget is defined as a plan or estimate of the amount of money needed for cost of living or to be used for a specific purpose. For me, I create my budget based on three parts: (1) income, (2) expenses and (3) saving. Firstly, income is the money you receive on a regular basis. The income could be the money ‘sponsored’ by your parents, the wage from your part-time jobs, and sometimes bursaries. It is very important to know how much you can receive for each month, as this will set the parameters of your spending. In other words, how much you gain would determine how much you can spend each month.

Secondly, to estimate your outgoings, you may need to figure out where all your money is going. You can either look back at your previous purchases at the bank statement, or simply estimate the expenses on each category. I classify the expenses into two categories: essential expenses and non-essential expenses. Essential expenses include rent, utility bills (gas, electricity, water, broadband, TV Licence), mobile phone billing, transport (e.g. bus, train, Uber, underground) and groceries. On the other hand, non-essential expenses could be eating out, clothes, haircuts, gym membership, travelling, and entertainment (e.g. nights out, hobbies, cinema ticket, concert tickets, books, subscription services like Netflix and Youtube). Those are the items which we can save money from, or should be avoided when we are short of money.

More importantly, my purpose to create a budget is mainly to figure out how much money I can save per month. There are tons of advantages of saving money, such as preparing for emergencies or further education. In my case, I save money for the tuition fee of a postgraduate degree, this would greatly reduce the financial burden of my parents, who have been working tirelessly for their children’s education. Moreover, I save 5 pounds per month for future investment. I have no idea about investment yet, but I think it is a good way to increase my income, apart from my part-time jobs.

Take me as an example, my income is mainly from my part-time jobs and my parents. My parents ‘sponsor’ my tuition fee and half of my rent, and I cover the other half using my wage. For the essential expenses, I have to pay half of my rent (£275) and groceries (£25), which is about £300 in total. This means that I have to earn at least 300 pounds per month from my part-jobs (this is why I apply for three part-time jobs—to earn more money hehe). I don’t really have non-essential expenses, as I always cook at home, do haircuts myself, watch movies at home. Whenever I earn more from part-time jobs/ spend less on groceries, I would save 5 pounds for future investment, and the rest for my future tuition fee.

As the saying goes, make a little makes a mickle. I believe that having good money habits like saving and budgeting would eventually benefit us. I hope that my sharing could somehow give you an idea about money management as a student. See you next week!